It’s fair to say that the PRINTING United Expo is more than a print industry event; it’s a promotional products trade show, too.

How else would you describe all the branded apparel? What else would you call the trade show signs that companies are printing and displaying? Heck, look at all of the drinkware and bags.

Each year, it seems that promo’s footprint at printing’s major global trade show in Las Vegas only grows as more suppliers within the promo space have their own exhibit booths and the trend of convergence among distributors and printers leads to more people who specialize in both.

PRINTING United Alliance’s new partnership with ASI is part of the growing promotional products contingent at the show, and Michele Bell, ASI’s senior vice president, content and global alliances, and Nate Kucsma, ASI’s senior executive director of research, took the stage at the event to speak to print distributors – some of whom are already doing promo, some of whom are not – about the business opportunities that promotional products present.

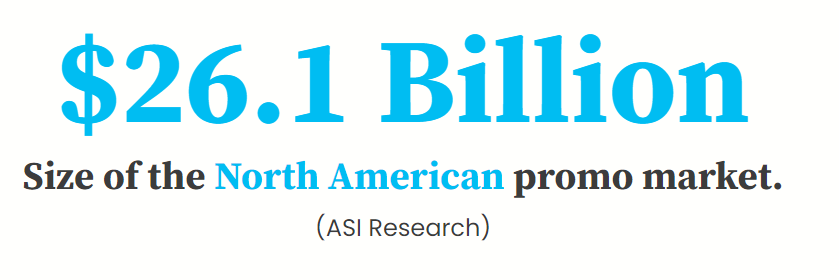

Offering a snapshot of the North American promo industry, Kucsma and Bell explained the overall promotional market spend, as well as where they draw a divide between two ends of the promotional products spectrum: wearables and non-wearables.

“By and large, apparel makes up some of the biggest categories, whether it’s T-shirts, polos or caps,” said Kucsma. “You’re talking about some of these making billions of dollars every year.”

When asked by an audience member why ASI included apparel with promos, Bell responded simply, “Why don’t you?”

The idea that any product that you can apply ink or thread to in order to make a branded item is a promo product seemed to resonate with the print audience.

Switching over to hard goods, Bell explained how pop culture and societal trends push certain items to the industry forefront.

“In this year’s data, drinkware is up at 10.7% of total promo industry sales, which is about $2.8 billion in the industry, and it doesn’t show any sign of slowing,” she said. “Stanley, of course, is the big name, and now Owala. Drinkware has really become like a fashion accessory.”

Meanwhile, Bell shared a timely point on the promo market: Every four years during the presidential race in the U.S., the merch market gets an approximately $250 million bump as political candidates at the national, state and local levels pump money into their campaigns. Interest in branded merchandise in the political realm has become even more pronounced in recent years, thanks in part to the ubiquity of the “MAGA” hats in the 2016 election.

“What really drove promo in political campaigns into overdrive was Donald Trump and the MAGA hat,” she said. “Now, every candidate leans heavily into promo.”

Top Markets

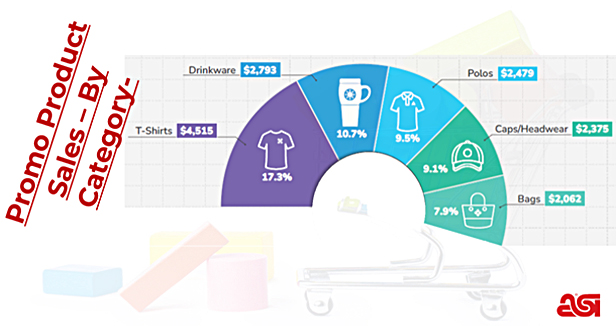

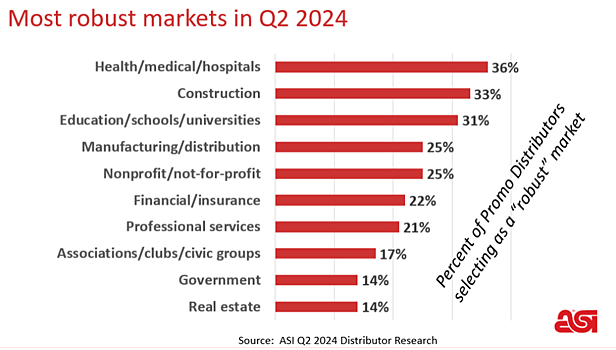

Bell and Kucsma also shared data on what end-markets are the largest purchasers of promo products.

Kucsma pointed out that education has been the No. 1 buyer vertical in promo every year for the last 10 years aside from 2020, when it was briefly dethroned by healthcare.

Bell, using the changing Las Vegas skyline as an example, also brought up construction.

“The amount of construction happening in this town, I just can’t believe it,” she said. “Think about what the construction industry needs. They need reflective vests; they need company stores so their employees can have hoodies and drinkware. Construction is one to watch. Keep an eye on that.”

Current ASI data shows construction making up about 7.8% of the overall promotional products market, worth about $2 billion.

In Q2 of 2024, construction was only behind health/medical/hospitals in the list of most robust promotional products buyer markets – ahead of even education and manufacturing.

At one point, an attendee noticed the financial market listed on the buyer market categories and asked what sorts of products they were buying. Financial markets are some of the most reliable customers for traditional printers, Bell said, explaining that a lot of the items the average bank customer might not even notice are promotional products.

“The most basic thing is the pen,” she said. “I go to TD Bank, and they still have that green pen in abundance.”

Kucsma added that the huge number of people employed with various financial institutions are recipients of branded products like uniforms and gifts, not to mention the big-ticket sponsorship programs they produce – like MetLife’s sponsorship of the New York Giants and Jets’ football stadium.

Niche Markets

Additionally, Kucsma and Bell explained the opportunities in smaller emerging markets. Two of the largest of these are pet products and e-sports, they said.

ASI Research found that 70% of U.S. households own a pet, and the U.S. pet market is estimated at $77 billion, with 5% growth per year forecast over the next four years. The global pet industry is estimated to be over $300 billion by 2030.

Veterinary offices, rescue programs, nonprofits and even subscription pet programs could be increasingly avid buyers of branded merchandise.

Meanwhile, another notable niche market opportunity for merch sales expansion is e-sports. Consider: the competitive video game space is high-growth, currently valued at $1.45 billion and estimated to grow 21.5% through 2030 to $6.7 billion. That spells plenty of nascent opportunity for promo sales.

What Customers Want

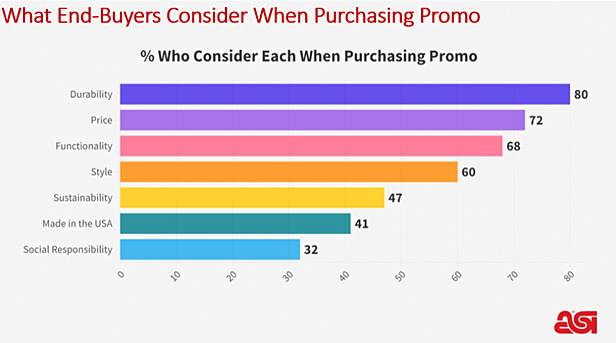

“When customers are purchasing promo, what are they concerned about?” Kucsma asked rhetorically during the session.

“Everyone would say price first, right?” he continued. “Well, it’s not.”

As the research executive explained, price does matter, but many buyers especially want quality and durability that will represent their brands well. “You want your end-buyers to give it to their customers, who will hold onto it,” Kucsma said. “If it’s a cheaply made item, like a pen that’ll break, it’s not going to generate the return on investment that the client is looking for.”

While the general data shows durability as the top concern for end-buyer customers, Bell pointed out that the numbers change depending on specific demographic variables.

“When you look at social responsibility, that jumps way up when you’re talking to younger buyers,” she said.

Taking a consultative approach with customers, rather than simply filling orders, is what sets distributors apart. Distributors already in the print or apparel industry have experience working with customers to find solutions and can appeal to customers buying promo by expanding that mindset and removing variables from their processes, Kucsma and Bell noted.

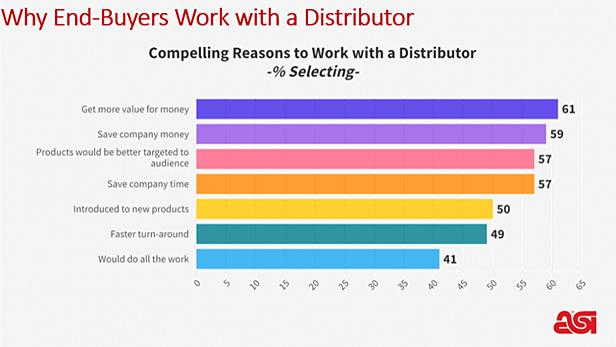

ASI data showed that 57% of end-buyers work with distributors to save company time; 41% say that they work with them to get the work off of their plate entirely.

“All of this indicates end-buyers are saying one big thing: ‘Make my life easier,’” Bell said. “A distributor who knows their business will know the details and will navigate a client through. Everyone’s got a finite amount of time. Are you going to pay a distributor to do that for you? In many cases, yes.”